The crisis has been so severe, the mindset of the traveller will be altered for a long time. The idea that things will return to normal is a narrative mirage, and that realization slowly settles in at the highest levels. At Limestone Capital, a private partnership founded by four passionate entrepreneurs in 2018, we prepare for the future, one that comes with new opportunities and challenges. Many of the articles in today's panic-porn and oversimplified news cycles, actually touch on trends that have been building for a long time. The crisis is acting as an accelerator, a disruptor - and makes it harder for legacy business models to be sustained. Below, we share some thoughts on the accelerating trends we’re observing right now, and the lessons we take away from it.

Entire industries are adapting to a post crisis world

The changing nature of work, is something anyone working in the world of technology has experienced first hand. Video calls, Slack, already made the desk a second priority. However, because of a forced mass adoption of these technologies, we will likely see a deterioration of demand in inner city commercial real estate as office space. Many CEOs consider to rent up to 30% less space in the future. Large office floor plans without much privacy, which have been in decline before the crisis already, become completely unappealing. This will depress not just inner city office space, coworking spaces and others, but commercial real estate demand as a whole.

Retail has been hit hardest, and the mega trend of retail moving online has been dramatically accelerated through the crisis. This should not come at any surprise, but the speed of change has been brutal for investors and owners. We went from years to weeks.

Businesses that run on thin margins, and are highly cashflow dependent such as Restaurants and Cafes, Gyms and Concert halls, will come out of this period severely damaged, either indebted or not able to return to business at all. Some of the most coveted institutions of our era such Eleven Madison Park in NYC are questioning if they should reopen to begin with. Who would’ve thought just weeks ago?

We might even see demand for residential housing in crowded inner cities falling, as people could consider a place further away from work, just to be able to have some outdoor space and take more advantage of digital collaboration in the future. Who wants to be locked into a city apartment for 2 months ever again? The rediscovery of the metropolitan periphery, nature and the great outdoors in exchange for the overcrowded city centre was well underway for many working remote jobs.

Any business will have to observe these trends closely and learn from them, adjust swiftly and find opportunities in the post crisis world to thrive.

What does this all mean for the hospitality industry?

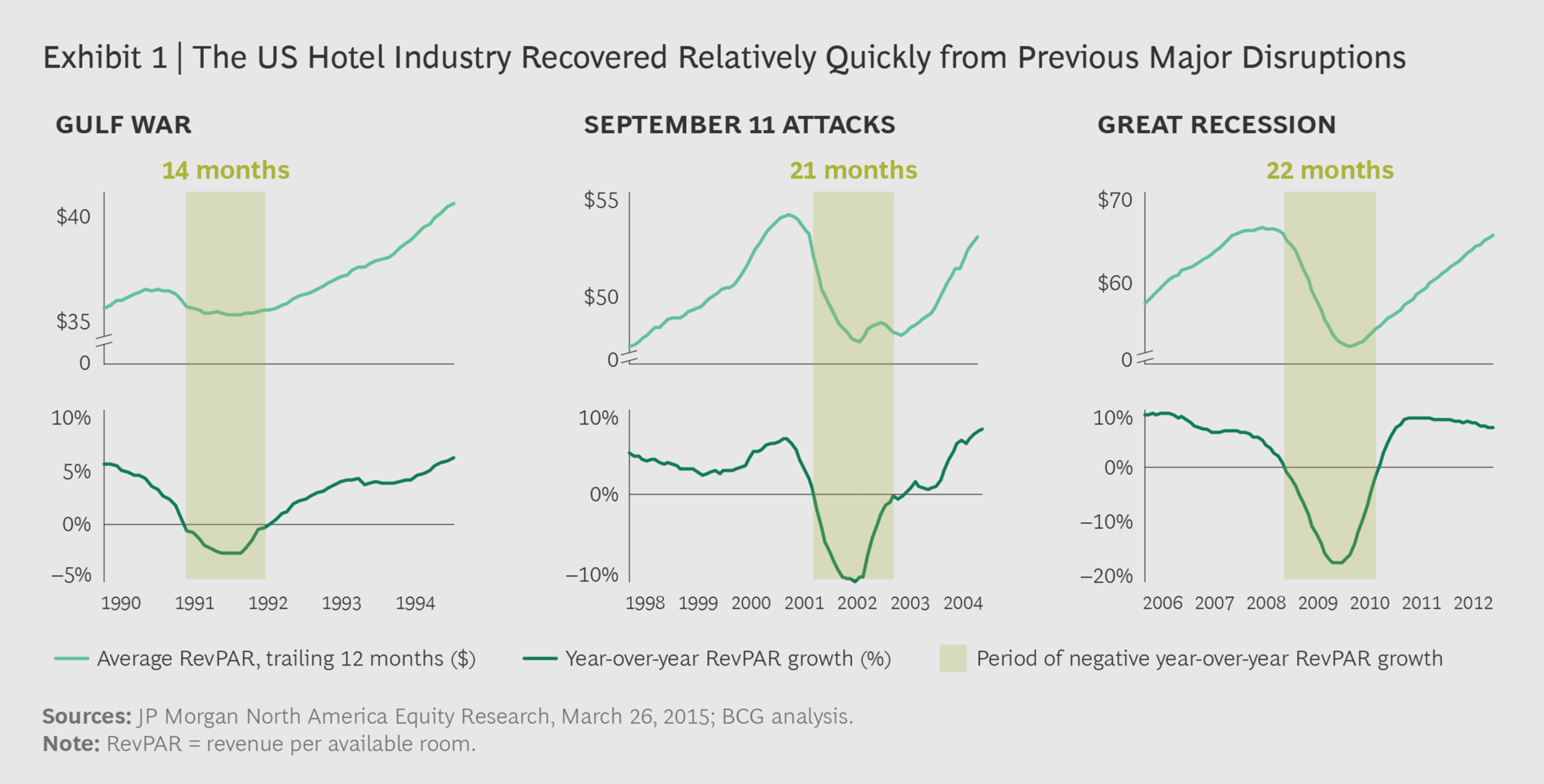

As we have seen after crises such as 9/11 or 2008 - even extraordinary events with a significant impact on travel don’t stop the long term demand for traveling abroad. After the last three major travel crises, took between 14-21 months to reach pre-event RevPar growth rates again.

Report by BCG: Breaking Ground on a New Era in Lodging

The changes to the comfort of travel after 9/11 were significant - long security lines, detailed checks, early arrival times at airports, to name the obvious, and still, the industry bounced back stronger over time. This time, there will also be new considerations that will impact travel for a long time, if not ever:

Cleanliness & health will become one of the leading factors to make a choice in accommodation. Does the hotel have a health or hygiene manifest?

Accessibility and “exit scenarios” might become a strong consideration. Travellers will consider how easy a potential return to home will be - to avoid a scenario being stranded on the other side of the globe like so many have just experienced.

The already existing mega trend in healthy lifestyle, conscious travel, and the emergence of the experience travel movement will result in a high demand for hotels that shelter the guest from the hustle of the crowded city.

Clubs and Social hubs will increase in relevance as more people work from home, and seek common spaces to interact with their peers as an alternative to the traditional office.

Back to nature: Venues and locations that offer green spaces and nature experiences will be even more in demand as people seek alternatives to the crowded artificial city landscapes.

Local escapes, within driving distance, will be among the first to rebound and enjoy a sustained revival in direct comparison to long haul travel, which might take up to 3 years to fully revolver, following this recent BCG report.

All of the above strengthen our beliefs in the re-emergence of the hospitality industry in a new formation, with new winners and losers - a process already ongoing for a while - but now accelerated. Large hotels, with long check in lines, impersonal disinfection-stations, and lots of personnel wearing PPE - will become ever less appealing to the modern traveller.

Boutique hotels that can offer a more personalised experience, away from the crowds, will be winning and taking share from large hotels that are dependent on tour operators. New lodging & experience concepts, that take into consideration the desires and concerns of tomorrow's traveller, will be taking market share from legacy players that will struggle with their re-opening positioning. Again, all of the above were trends already underway for niche audiences, however they will become more and more mainstream moving forward.

Entrepreneurial investors will make the most of it.

Investors able to identify the cracks in the market and invest at discounted valuation, will be the big winners in the growth cycle that lies ahead of us. Risk takers, that can see beyond the panic machine of the media, and make long term investments for a new travel reality, will be outperforming the mainstream.

Here at Limestone, we have the mission to invest in sustainable luxury real estate that caters to the modern, conscious traveller of the future. We create homes for the urban, creative crowd, as well as leisure and business travellers coming to town or a unique destination to seek a sanctuary. We recently acquired a unique asset in central Lisbon that stands apart from the traditional city boutique hotels, with gated, lush oasis-like gardens that offer privacy for members & guests. Still this year we will open our first hotel in Italy, a remote but easily reachable suite-only destination outside of Rome. We strongly believe in destinations that are boutique in size, offering guests to retreat and disconnect.

As an industry, we will come out of this stronger than before, as the change of the guards is now drastically accelerated. While this process is painful for everyone as a whole, it’s also an exciting fresh start and a monumental opportunity for entrepreneurial private equity investors and entrepreneurs carrying out a new vision and being well prepared for a new paradigm in lodging, real estate and consumer behaviour.